Supercharge Your Money Management and Growth Ability!

As with most things, we learn to be better at what we want to do and this includes our money management and growth ability. It is always easier to leave to the ‘professionals’ to do it, if you are willing to pay them first before yourself.

I rather not since I am not aiming to beat the market or get the best ‘deal’. I also prefers to have more control over what I am comfortable with putting my money into.

Hence today’s post will be my first book review: a book in my opinion is one of the most critical reading I have come across! It anchors the lessons I have paid my price for over my 15-year journey so far. I often wondered how different might my first 14 years be, if I had this book much earlier.

Maybe I could avoid some mistakes and the price paid for them. I hope you will avoid them too as you read my lessons and insights gained, to supercharge your money growth ability!

Better money management and growth: know what your money does for you

Cashflow Quadrant, a book by Robert Kiyosaki famed for his Rich Dad Poor Dad books, is something close to a game-changer for me. Not that I can rapidly grow my wealth with it, but simply be better at avoiding another pricey lesson. Even though the book is set in a US context, there are some key principles you could adapt for your country and her applicable laws. I have listed below what some critical insights I had gained and practiced.

- The importance of clarifying the purpose of your goal (what you want to do with the money) and financial goal (how much money).

- A framework to think about money management and investments.

Sounds simpler than it really is! 1 key lesson is how to differentiate between good or bad investments. And that is already half the battle won. 🙂

The beauty is that the insights and principles in the book applies to anyone! Even if you have little or no means! It is definitely a keeper for re-reading! 🙂

What your income statement and balance sheet show you about money management and growth

I will just share more about the ‘game-changing’ part that I learnt, which what the header above indicates. Not the accounting type of income statement and balance, but how your money flows in and out. I thought this is a really good framework to think about money management and investments!

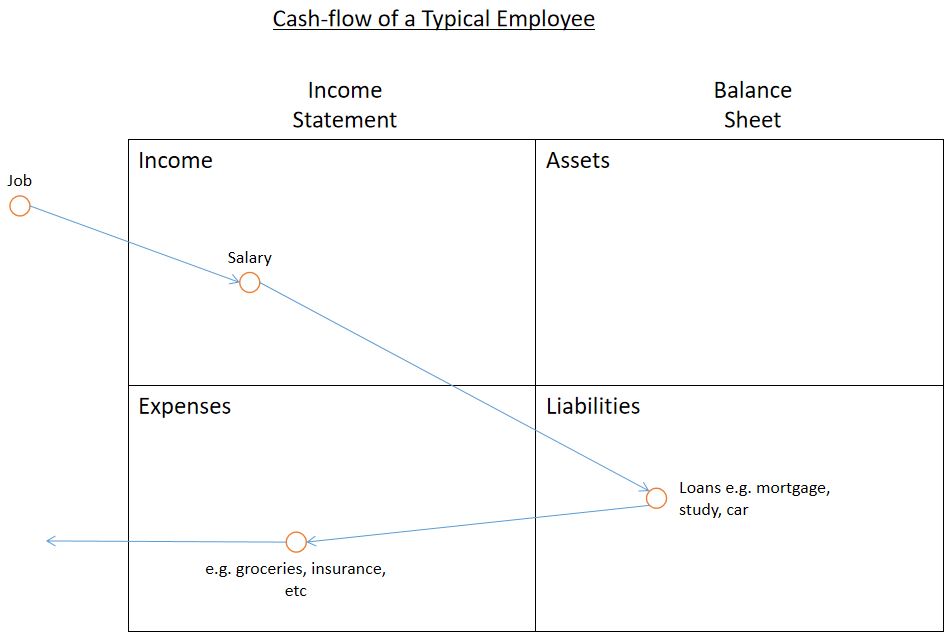

The illustration above shows the cashflow of a typical salary earning employee. Typically when its payday, the money will flow first into paying off recurrent liabilities such as loans. It then goes to paying off day-to-day expenses. For many employees, they might end the month with not much money left, living salary to salary.

It is also quite common when we get larger salaries, we tend to either buy more liabilities (e.g. bigger house, better car). We might also increase our expenses (e.g. eat out more often or at nicer restaurants). Hence the key change in action is to focus on:

- earn more,

- spend less,

- reduce liabilities, and most importantly

- grow assets.

Isn’t this a great framework to think about money management, especially to assess whether you have been growing your asset?! The realisation from the simple graphical illustration of how money flows through your life is the first step to supercharge your money growth ability!

When buying a property does not equal buying an asset

As I read more of the Cashflow Quadrant, the basic premise of an asset is that it must earn you an income or profit in order to be qualified as an asset. Until it actually earns you an income (e.g. from a sale), it might be a liability that incurs expenses.

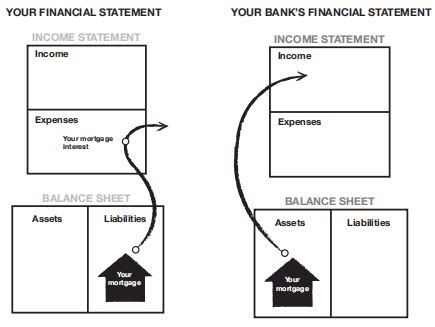

A prime example (in Singapore at least) is property upgrading as a form of investment. It is often touted as a great way to build wealth as land is limited in Singapore. However, it is not true in all cases. You got to be very clear in your calculations how your cashflow will work out. Fundamentally, the graphical illustration below is true for most property mortgages.

Simply buying a property may not necessary be an asset. Until you are able to sell for a profit after some years, it is a liability your money is flow into. How much you can sell for is also dependent on how the market is when you want to sell. Even if you have the cashflow to afford a second property to rent out, keep a clear mind to avoid being swayed by others. Volatile market and interest conditions can easily erode your wealth!

What is important is always better safe than sorry. Learn to do your own calculations, read/learn more about this investment method and the applicable laws/regulations of the country you are buying in, before putting your hard-earned money in!

Cashflow is King

Really, every aspect of our life depends on our ability to manage our cashflow. This means living beneath our means and saving for a rainy day. This is also true for where we decide to place our hard-earned money, whether investing to grow our wealth or simply to grow our savings.

Go read Cashflow Quadrant, pick up whatever insights that applies to your situation and context, and supercharge your money management and growth ability!

MrAmass