Harvest Cash, Not Paper Gain, for Wealth Growth

Of all the lessons and insights gained from my journey in growing my savings and wealth so far, this last of my ABCs principles learnt is far by the most important lesson I have learnt: cashflow is king and a true asset puts money into your pocket. Thankfully, I have paid my price for this lesson only thrice in the past 15 years and I hope you do not have to go through the same lessons I did.

There are 3 main ways to grow our savings and wealth:

- Consistently deposit money into a bank savings account and wait for it to grow;

- Consistently purchase an investment product and wait for it to grow; and

- Periodically, when you have a large enough sum of money, buy into an investment product and wait for it to grow.

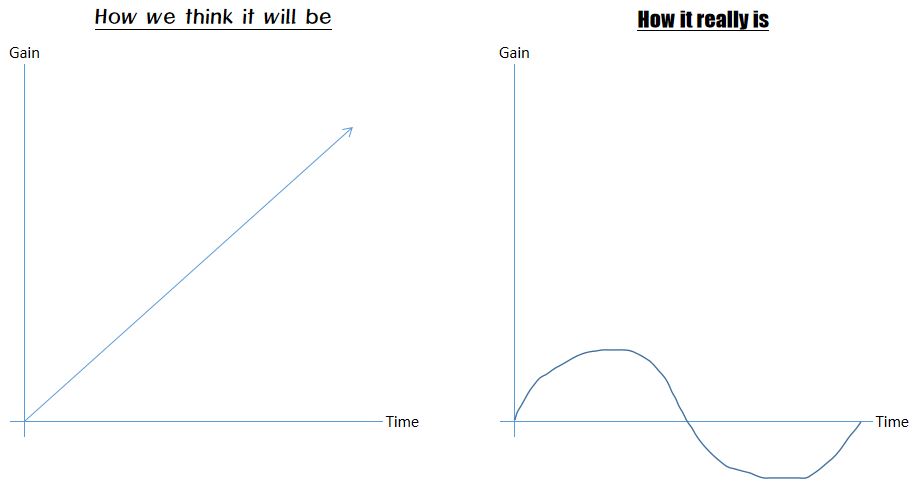

All requires you to put your money somewhere and wait, and a common logic is the longer you keep your money in, the more gain you should get out from them. Some more experienced investors might say there are ways to invest without using your money but these are really risky, and I cannot afford the ‘lessons’ to be good enough at it. Based on the relationship above between time and gain, let’s take a look at a common assumption many of us might have – I did at first too!

You win some, and lose some

There is a reason why everyone, including the government, will tell you every investment vehicle has it’s risks – including banks (which insures only deposits up to SGD$75,000 per bank) and government issued bonds. When the market is doing well, it is common to think like the chart on the left above. However, you never know when it will turn out to be like the chart on the right – the reality of the sentiment-driven market.

The lessons I learnt here is that when you put your money into investments that you need to hold and wait for the value to grow, you might find yourself facing the possibility of a sudden change in market sentiment and find your paper gains (paper because you have not sold your investment to get the actual gain) reverse into paper losses. Even today, I find myself in a position which I cannot sell some of my investments and is ‘forced’ to keep my money locked-in the investment (otherwise my paper loss will become a real loss) and wait for the market to improve before I do anything with it – I can only pray I will not face an emergency which I will need these money for!

As I learnt these lessons over time, I also began to be more selective shifting my investments into vehicles that are either 1) short-time (1 year or less) and provide a reasonable guaranteed gain, or 2) issue dividends in cash or reinvested as shares. In these cases, as I had mentioned in my previous article, I will select what I think are the more resilient options such as treasury bills, Singapore Savings Bonds, and index-tracking ETFs.

The key rationale for me is that even when the market is not doing well, especially in the case of the stock market, I will still be able to reap cash dividends that will give me the freedom of choice to decide on what I want to do with these cash dividends – this feeling is so much better than being forced ( 🙁 ) to keep my money in a stock that is not doing well!

Cashflow is king

I feel a true asset puts money into your pocket when you can see and collect gains, despite how the sentiment-driven market is doing at any time. This applies to any investment or saving product, whether you buy into real estate, or endowment or annuity plans for future income.

A ‘promise’ of future value and paper gain is ultimately only a possibility, and we know promises can be easily broken. Grow your knowledge, do your own math, and aim for the cashflow!

MrAmass

1 thought on “Harvest Cash, Not Paper Gain, for Wealth Growth”